It is a well-known fact that 70% of Romanians do not exercise their rights while living or working abroad. One of these rights is the ability to claim income taxes that may have been overwithheld while working abroad.

If you have worked or are currently working abroad within the last five years, you may be entitled to request a refund for overwithheld income taxes. Overwithholding may have occurred because your employer(s) may have withheld more taxes than required or because you may have been placed in a higher tax bracket. It is important to note that this overwithholding is perfectly legal.

The tax refund amount varies based on several factors: income earned abroad, income obtained in Romania for the given year, marital status, and spouse's income earned in Romania. Understanding these factors can empower you to make informed decisions and potentially increase your tax refund amount. In certain situations, tax refunds can include social benefits such as child benefits provided by the EU Regulations.

It is also worth knowing that tax refunds are received at the tax preparer's office and not from your employer. The process is straightforward, and your right to receive a tax refund does not interfere with your ability to work abroad or your relationship with your employer.

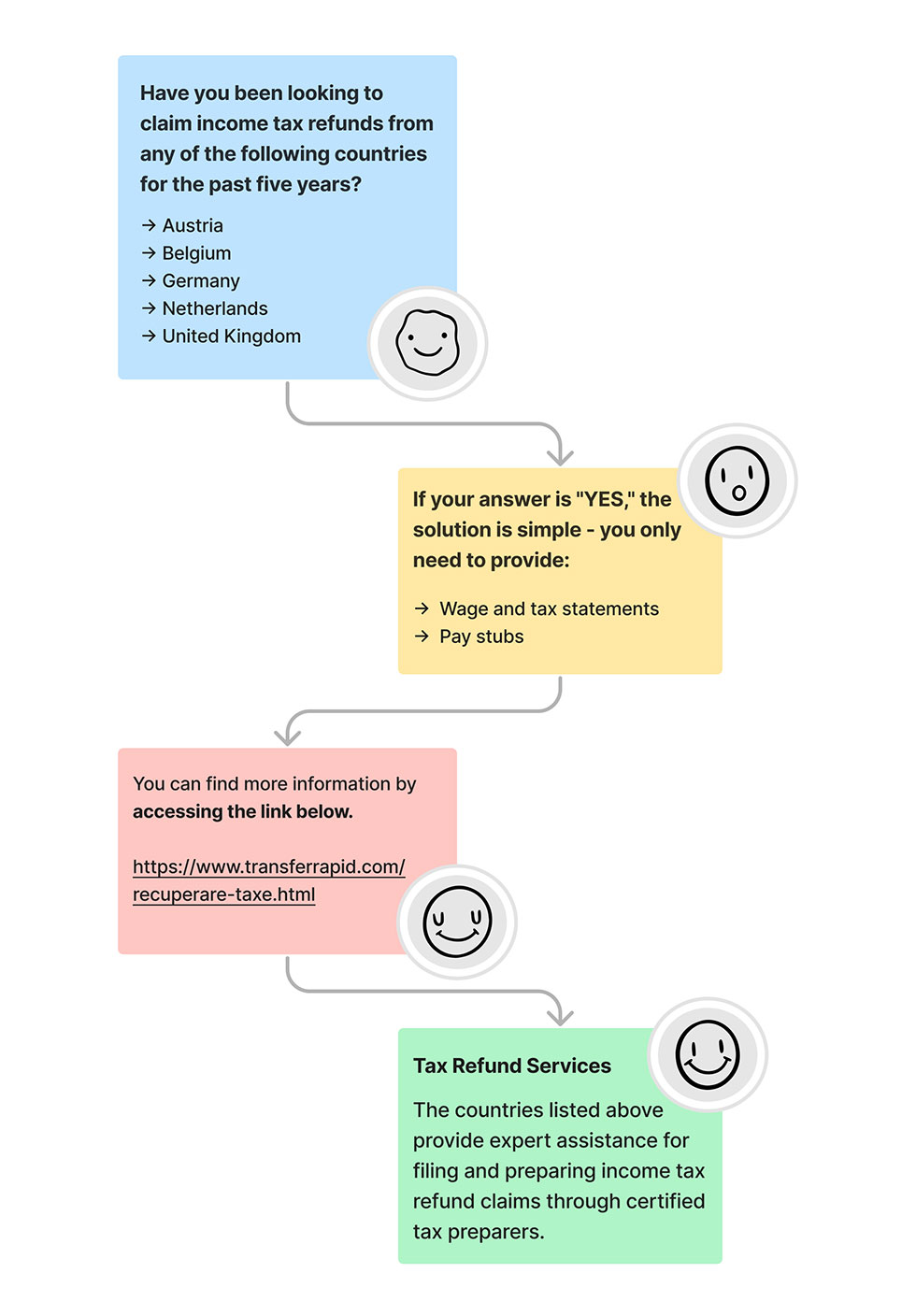

For more information on tax refunds, please access the following link: https://www.transferrapid.com/recuperare-taxe